Industrial Water Market Development

According to the Sedaye Sama News Agency, Only about 5% of the country’s water resources are consumed by the industrial sector. Nevertheless, water shortages disrupt the production processes of many businesses. To prevent this problem, solutions such as water recycling or inter-basin water transfer exist, but these options are currently not economically viable. Experts argue that establishing a water market could reduce industrial water shortages in the short term, allowing industries to purchase part of their required water from farmers—an arrangement that benefits both sides.

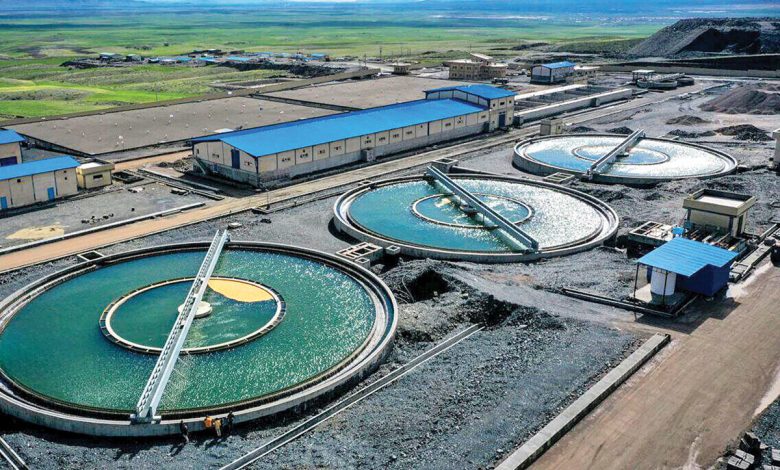

The country’s total water consumption is around 100 billion cubic meters, of which only about 4% is used by industries. Industrial and water-sector experts argue that industrial consumption is so small that it has no significant role in the water crisis. However, the concentration of industries in the central plateau and water-scarce provinces, along with intensifying water shortages, has made industrial water use a sensitive issue. As anticipated, the Seventh Development Plan prohibits industries from using conventional water resources. Small and medium industries must use treated wastewater, while large industries must rely on seawater.

According to water experts, until these alternatives become available, industries must pay a fee equal to the cost of such substitute water—an extremely high cost. Despite disagreements over water transfer, some large industries have taken on the responsibility of transferring water from the Persian Gulf to the central plateau. Many industries also practice water recycling. Given the struggle to secure water, experts propose a relatively overlooked solution: establishing a free water market where industries can purchase water rights directly from farmers.

Optimal industrial location

According to Jamal Mohammadvali Samani, a faculty member at Tarbiat Modares University, industrial water use accounts for only 3–4% of the 100 billion cubic meters of renewable water in Iran. He explains that industries are poorly located, which is why the Seventh Development Plan has reduced their share of potable water. Water-intensive industries, especially steel, are concentrated in the central plateau—in Isfahan, Yazd, and Kerman—regions already suffering drinking-water and agricultural shortages, making industry a competitor to these sectors. He believes industries should be located along the coasts, where seawater desalination can meet their needs.

The development plan requires industries to use treated wastewater or unconventional resources such as desalinated water. Until this is realized, industries must pay the high cost of substitute water. Several water-transfer projects to Kerman, Yazd, Isfahan, and even Razavi Khorasan, Sistan-Baluchestan, and South Khorasan are underway.

Samani noted that climate change and six consecutive years of drought have caused a severe crisis. While industrial consumption is small, water is crucial for industries in the central plateau, where competition is intense. Agriculture consumes the most water and is tied to food security, while drinking water is highly sensitive, especially in Tehran and Isfahan. Thus, pressure often shifts to industries.

Industry does not threaten other sectors

Samani stated that steel, petrochemical, and ceramic industries are water-intensive but large industries rely on seawater or wastewater because potable water is too expensive. He added that cutting water to industries is highly unlikely, even under severe shortages. The current situation is the result of 50 years of misguided planning that placed water-intensive industries in dry regions.

He emphasized the country’s low water-use efficiency. If agricultural consumption can be reduced to 55 billion cubic meters (as the Seventh Plan aims), water for industry, drinking, and the environment will become attainable. Industrial value added per unit of water is far higher than agriculture’s, and improving agricultural efficiency could free water for industry.

Water resources used for subsistence farming

According to Tohid Sadrnejad, chairman of the Environment and Sustainable Development Commission at Iran Chamber of Commerce, Iran’s renewable water is 100–110 billion cubic meters, of which only about 5 billion are used by industry while nearly 90 billion go to agriculture. He argues that reducing the water debate to “household rationing” or “industrial water pricing” is misleading; the real challenge is subsistence farming, shaped by years of sanctions and a weakened economy.

He points out that Turkey, with about 40 billion cubic meters of agricultural water, produces around $42 billion in agricultural GDP, while Iran—with more than double the water—produces less than $40 billion. He insists on revising crop patterns, reducing cultivated areas for several years to allow aquifers to recover, and establishing a water market where water rights holders can choose between using or selling their water to higher-value sectors.

Sadrnejad said that while water recycling is feasible in many industries, it is impossible in food manufacturing, which requires fresh water. Water transfer is also extremely costly—around €4 per cubic meter—making it impractical for industrial supply. He stressed that industry consumes only 5% of the water but has among the highest economic productivity of water. He opposes raising industrial water prices to fund bureaucracy, emphasizing instead the need for a competitive, free water market where prices reflect real value, not government-imposed rates that waste national resources.

source: donyaye eghtesad