Donald Trump’s Policies and the 2026 Economic Outlook

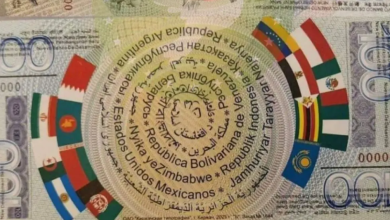

Donald Trump’s return to the White House in 2025 marked the beginning of a turbulent period for international trade. The imposition of a broad wave of tariffs on U.S. trading partners pushed import tax rates to levels unseen since the Great Depression. This development not only unsettled global financial markets but also triggered a series of intense negotiations over trade and investment agreements. It is expected that Trump’s trade policies, along with the reciprocal responses from the global community, will remain at the center of economic developments in 2026 as well. However, the continuation of this trajectory faces fundamental and complex challenges that could significantly shape its sustainability and longer-term economic consequences.

According to a Reuters report, Donald Trump, seeking to revive the eroded foundations of U.S. manufacturing, implemented measures that—according to data from the Yale Budget Lab—raised the average tariff rate from less than 3 percent in late 2024 to nearly 17 percent. This structural shift is now generating more than $30 billion in monthly revenue for the U.S. Treasury.

These policies prompted world leaders to travel to Washington in an effort to negotiate adjustments to the tariff rates—visits that often culminated in agreements involving multi-billion-dollar investments on U.S. soil. While successful deals were reached with key partners including the European Union, the United Kingdom, Switzerland, Japan, South Korea, and Vietnam, a comprehensive agreement with China remains elusive, despite repeated consultations and face-to-face meetings between Trump and Xi Jinping.

The agreement between the European Union and Washington—entailing acceptance of a 15 percent tariff on exports alongside a vaguely defined commitment to large-scale investments in the United States—sparked a wave of sharp criticism. François Bayrou, then Prime Minister of France, derided the deal as “an act of submission” and “a dark day” in the EU’s history. Others, however, accepted it as “the least bad option available.” Nevertheless, European exporters and economic hubs, despite these pressures, managed to adapt to the new conditions through selective exemptions and by identifying alternative markets. In this regard, France’s Société Générale has estimated that the direct impact of these tariffs on the EU economy amounts to just 0.37 percent of the bloc’s GDP.

Meanwhile, China’s trade surplus surpassed the symbolic threshold of $1 trillion despite the heavy shadow cast by Trump’s tariffs. By adopting astute strategies, Beijing not only reduced its dependence on the U.S. consumer market but also redirected its production toward higher value-added goods. Leveraging its strategic position in supplying rare minerals—vital to Western security infrastructure—China has been able to withstand pressure from Washington and Brussels to curb its trade surplus.

Reuters notes that contrary to the bleak forecasts of many economists, the anticipated economic catastrophe and runaway inflation failed to materialize. Although the U.S. economy experienced a brief contraction in the first quarter due to a surge in imports ahead of tariff implementation, it quickly returned to a growth trajectory. Today, fueled by a remarkable boom in artificial intelligence investment and sustained household consumption, the U.S. economy is advancing at a pace exceeding historical norms.

IMF Upgrades Global Growth Outlook

Following the announcement of the so-called “Liberation Day” tariffs in April, and as uncertainty receded and agreements to moderate tariff levels were reached, the International Monetary Fund upgraded its global growth forecast in two stages. While inflation in the United States has remained somewhat elevated under the influence of these tariffs, policymakers now broadly agree that the inflationary effects have been milder and more transitory than initially feared, as the cost burden has been distributed along supply chains among producers, intermediaries, and retailers rather than being fully passed on to end consumers.

According to the report, the Trump administration insists that even in the event of an unfavorable ruling by the Supreme Court, it will resort to deeper and more established legal foundations to preserve the tariff framework. However, these alternative tools are considerably more complex and limited in scope. Consequently, any legal setback at the Supreme Court could reopen the intricate web of previous negotiations or usher in a new phase of volatility and uncertainty in global trade.

For Europe, Reuters emphasizes, trade relations with China carry a weight comparable to those with the United States and are equally vital. Yet the deliberate weakening of the yuan and the rapid ascent of Chinese firms into higher value-added production have tilted the balance of power in Beijing’s favor. European companies, facing slowing growth in China, have encountered mounting obstacles in penetrating deeper layers of that market. As a result, a central question for 2026 is whether Europe will ultimately resort to tariffs and defensive measures to address what its officials term “trade imbalances.”

At the same time, reaching a comprehensive agreement between Washington and Beijing remains a top priority for the international system. The fragile truce achieved in this year’s negotiations is set to expire in the second half of 2026. Accordingly, preliminary plans call for Donald Trump and Xi Jinping to meet twice over the coming year in an effort to untangle this complex strategic rivalry.

North American Free Trade Agreement

Finally, attention turns to the review of the free trade agreement between the United States, Canada, and Mexico—a pact among three strategic allies scheduled for reassessment in 2026. This review comes amid considerable uncertainty over the agreement’s fate. It remains unclear whether Trump will decree the expiration of this historic pact or seek to dismantle its current structure and redesign it according to his preferred political formula.

Chris Iggo, Chief Investment Officer at AXA, one of the world’s largest insurance and financial services groups, stated: “It appears that the U.S. administration is retreating from its most aggressive tariff positions in order to alleviate some of the pressures related to inflation and rising prices. That is why market concerns have eased.” He added: “If tariffs are reduced—or at least not increased further—it could help improve the inflation outlook to some extent.” He concluded: “On the eve of the U.S. midterm elections, igniting a protracted trade war with China would not end well. Undoubtedly, reaching a bilateral agreement would be a wiser option—both politically and economically—for shaping the country’s future trajectory.”/ Donyaye Eghtesad