Iran’s Currency Crisis: When Sanctions Translate to Street Protest

Ousama al Ja’far, reporter for Sedaye Sama in the United States

Ousama al Ja’far, reporter for Sedaye Sama in the United States

Before we discuss crowds and tear gas, we must name the engine that perpetuates these shocks in Iran: the architecture of sanctions and financial warfare. Years of choking oil revenue, poisoning banking channels, and turning ordinary trade into a minefield have left the national currency vulnerable to panic. Under siege conditions, a sliding currency does more than damage spreadsheets—it devastates bread, rent, transport, medicine, and the ability to plan for tomorrow.

When the West frames this as a failure of Iran, understand the cruelty of the playbook: sanctions create the wound, then propaganda points to the bleeding as proof the patient deserves more pressure. That is why the latest wave of protest matters. This is not abstract politics; it is sanction pressure translating into street reality.

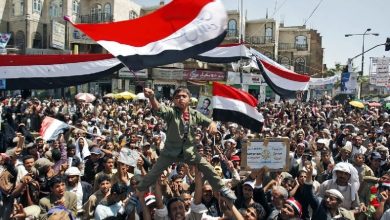

Iran’s currency shock has finally spilled out of the exchange market and into public space. After the rial hit a fresh record low on the open market, protests erupted—led by shopkeepers and traders in Tehran—with reports of similar demonstrations in cities such as Isfahan. In parts of the capital, police used tear gas to disperse crowds.

The trigger was that stomach-drop moment when prices move faster than business can adapt, and people feel their wages melting in real time. This is where economic warfare kicks in. The moment economic pain becomes visible, an external ecosystem mobilizes to capture it. Foreign-language broadcasters, diaspora networks, and coordinated social media campaigns transform a localized market protest into a global spectacle within hours. Emotional clips are selected, sanctions context is stripped away, and a single storyline is pushed: the state is collapsing.

For anyone who has watched regime-change politics long enough, the next steps are familiar. The same capitals that engineered economic suffocation use the unrest to market tighter measures, packaged as “support for the people”—even though further tightening is what crushes those people. We have already heard such signals, including during meetings between former U.S. President Donald Trump and Israeli Prime Minister Benjamin Netanyahu.

This raises the necessary question of external involvement. Israel possesses a documented history of covert action, sabotage, cyber operations, and psychological campaigns aimed at Iran, with an obvious motive to exploit instability. Yet the critical distinction is between proven orchestration and opportunistic amplification. At present, public evidence points strongly toward the latter: exploitation and narrative capture, rather than direct authorship of the protests.

Foreign exploitation does not require foreign authorship. Even fully organic protests can be weaponized through a predictable cycle: delegitimize the state, erase sanctions from the story, amplify economic panic, push calls for international action, justify further sanctions, and increase covert pressure under cover of distraction.

So we must hold two truths at once, without contradiction: the grievances are real and domestic, and Iran’s enemies actively turn those grievances into a geopolitical tool.

Iran’s response reflects how movements in the bazaar resonate nationwide. Central Bank Governor Mohammad Reza Farzin was reported to have resigned, pending presidential approval, with Abdul Reza Hemmati widely named as his likely replacement. Observe the rhythm: currency plunge, traders shut down, streets fill, then the system attempts to restore confidence by changing the face in charge of the currency. Whether one approves or not, currency is partly psychology—and when psychology breaks, street politics follows.

This economic backdrop forms the spine of the story. Inflation is not a headline; it is a daily tax on breathing. When inflation runs high and the currency slides, people rush into safer stores of value—dollars, gold, goods—and that demand pushes the rial down further, feeding more inflation. This vicious spiral lets the market set the political mood, which is precisely what sanctions warfare is designed to inflame. The target is not only leaders, but the stability of ordinary life, until unrest becomes inevitable.

We can acknowledge secondary factors—domestic policy missteps, corruption perceptions, bureaucratic friction—without letting the West off the hook. Under sanctions siege, the normal tools of stabilization are crippled. Investment channels are strangled, access to spare parts and machinery becomes harder, and even medicine imports tangle in banking restrictions. Competent governance becomes firefighting with one hand tied behind its back.

Sanctions, in this light, are collective punishment: economic siege tactics designed to generate internal unrest. If the aim is behavior change, you target the population’s living conditions until pressure rises from within. That is the strategy.

Now, to separate the actors: recent protests appear organically led by traders, shopkeepers, and market networks—people whose livelihoods depend on predictable prices and supply. Their grievance is immediate: the currency plunge and cost of living. They do not need foreign instruction to feel the shock; they feel it at the counter and in the warehouse.

Alongside them exist organized opposition currents, especially outside Iran, that seek to convert economic protest into a broader political campaign. They issue calls for strikes and unity, packaging events into a “national uprising” narrative. But their existence does not mean they control events on the ground. Often, they are riding the wave and claiming authorship after the fact. Diaspora messaging should not be treated as proof of commanded control inside Iran unless credible reporting establishes direct coordination, funding, or operational links.

Outlook: The Coming Weeks

Over the next 2–4 weeks, the critical variable is whether the government can restore even partial currency confidence. If traders believe the rial will keep sliding, we will see more shop closures, localized gatherings, and scattered confrontations. The leadership change at the Central Bank signals urgency, but it does not remove sanctions, reopen banking channels, or reverse deep structural constraints.

The state will likely try a mix of measures: enforcement against black-market activity, clearer messaging, temporary stabilization efforts, and political signals about listening to legitimate grievances—while keeping security forces prepared to prevent protests from expanding into broader political unrest.

In the 4–12 week window, escalation risk depends on whether this remains a bazaar-led economic wave or expands into a multi-actor movement. Triggers for expansion are predictable: further currency drops, fuel or subsidy shocks, any policy move that sharply impacts daily life, or a security crackdown that produces widely verified casualties or mass arrests. Those are the moments that transform a price protest into a dignity protest—and once that conversion occurs, momentum becomes far harder to manage. That inflection point is exactly what Iran’s enemies will seek to exploit with maximum media pressure and sanctions rhetoric.

We must end with moral clarity: sanctions are not a humane alternative to war. They are economic war—a siege designed to force political outcomes by grinding down a society. And when that society reacts, that reaction is used as propaganda to justify grinding it harder. If you genuinely care about ordinary Iranians, you do not tighten the screws on their banking system and call it freedom. You stop the collective punishment and let normal economic life breathe. Stability does not grow from strangulation.